Retirement Road Map

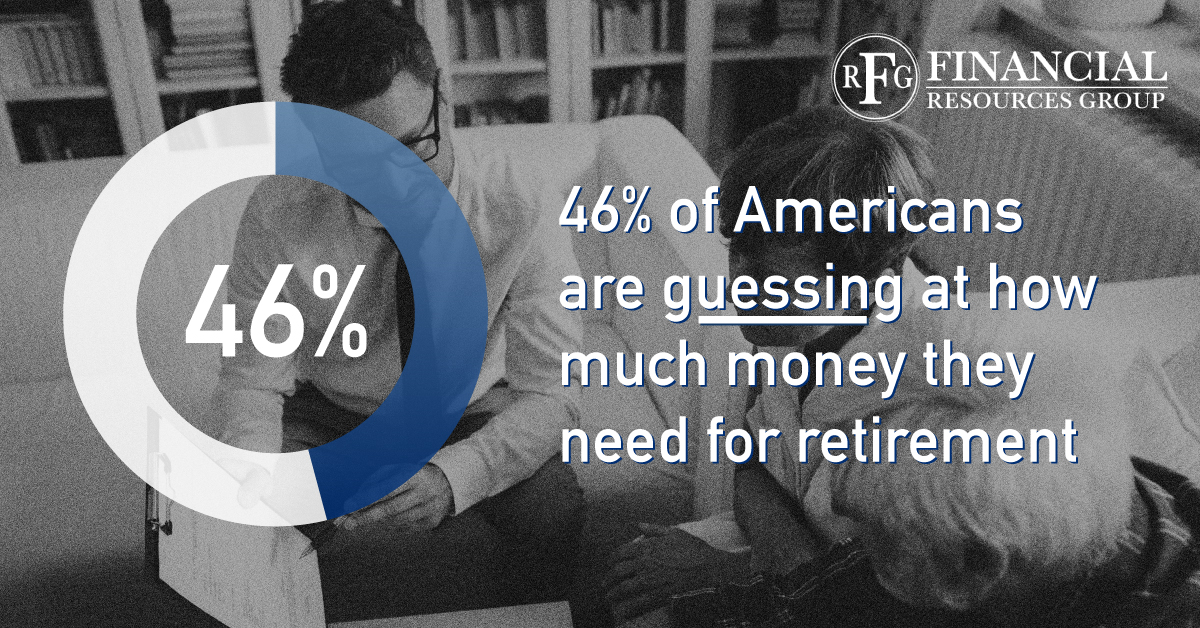

Take the first step to protect yourself. The pandemic has created a lot of unexpected events, has impacted the markets, and has caused each of us to adapt to the changes. Now is a good time to review how your needs may have changed and what you’ll need to adjust in the future. To get started, ask yourself if your retirement goals remain the same or if they’ve changed. Then outline where you are today. Depending on your life stages and retirement goals, you may need to account for additional risks you didn’t need to factor in before. Call us